Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Home Equity W Bad Credit

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. The number one reason people have poor credit scores is the inability to make timely payments on the loans they already possess. It’s this amount a home equity credit loan uses to give you cash. There are all sorts of work from home ventures out there and you may have seen. The articles and information available on this site are for educational and reference purposes only. Super Affiliate Marketing Tips To home equity w bad credit Boosts Your Affiliate Profits.

Prerequisites for this course are next to none. This usually comes down to how long it takes to completely pay off a loan. Privacy Matters and its benefit providers are not credit repair service providers and do not receive fees for such services, nor are they credit clinics, credit repair or credit services organizations or businesses, as defined by federal and state law. This MBA course and registration will be through the MBA Auction.

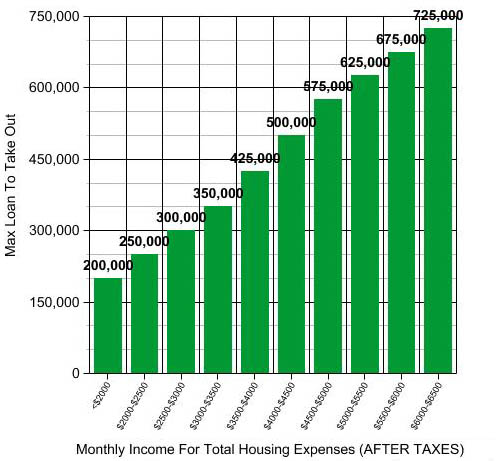

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. Privacy Matters does not control or guarantee the accuracy of any information provided through external links from the articles on this website to any other website, nor does the Privacy Matters privacy policy apply to any personal information that may be collected via the external links. The then-current real estate market determines the prime rate, so home equity w bad credit that will depend on when you apply for the home equity loan. Second, you must consider potential upfront fees, commonly referred to as points, with one point equal to 1% of the entire loan amount. Having bad credit virtually guarantees that getting home refinancing or a home equity loan will be more difficult, and no precise line exists between bad and acceptable credit.

Also, your home may not have the collateral required for the loan. Perhaps you’d never thought of your home as a source for the cash to finance an education for you, your spouse or your son or daughter. Prerequisite for this course IS Fixed Income. An education will provide life-long benefits including the training to succeed in our rapidly changing world. The professor will teach one MBA section and one Undergraduate section.

This site is directed at, and made available to, persons in the continental U.S., Alaska and Hawaii only. Super Affiliate Marketing Tips To Boost Your Affiliate Profits.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Bad credit, as long as you are current and not in default, may not be home equity w bad credit the stumbling block that it is in obtaining other types of loans. Because secured loans have property (your home) attached to them that can be repossessed if you fail your repayment. Privacy Policy | Terms of Uses | Contact LoansStore.com.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

However, when looking for loans with bad credit, a secured home equity loan will be far easier to acquire. Home equity line of credit rates are attractively lower than many other types of loans. Think of it as a separate savings account, a bargaining chip for your financial future. But you may also be worried about your credit score. E-LOAN connects you with one of our trusted lending partners, so you can compare rates and terms to find the loan that’s right for you. Enrollment for this course is by application only

With bad credit, your options for home equity loans are still somewhat limited. As you continue to pay off every chunk of the "principal" — the amount of the loan you received before interest — every payment you make is yours to borrow against. Business Advertising Strategies for Home Business.

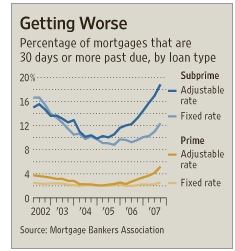

You can clean up old debts, and get on the road to a better credit rating. Keep in mind that most home equity loans are adjustable rates. While not all homeowners may qualify, particularly if you had a no down / low down payment mortgage and you have recently purchased your home.

Secure Your Financial Future with an Online Home-Based Business Opportunity. Similar to late payments, having too many open, active credit accounts makes lenders think you are constantly looking for money. Pay them off and start keeping more in your pocket so your next purchases can be paid in cash. When you apply online you have access to lenders for all credit types. If you have filed for bankruptcy in the recent past (less than two year ago) you will not be able to get another loan.

Many homeowners give up trying to get approved for a home loan to soon. Acquire the skills needed for a job fairs work successful job fair experience. Affiliate Marketing Tips That Super Affiliates Apply.

Because you are putting up your home as collateral, it is extremely important that you choose a line of credit that fits your budget--now and in the future. Of course, using the value of your home as leverage any time that you want to borrow money can be a risky venture, and it is only possible for as long as you have equity (or value) in your home. We have the competitive loan rates and terms suited to your needs available at LoansStore.com. For more information about FDIC insurance coverage, visit www.fdic.gov. Many factors that seem obvious will affect your credit score, including missed or late credit card payments.

This secured loan option is the best choice for those whose credit scores are low. But home equity loans have never been more prominent. Byrider offers no money down bad credit auto loans with cnac financing.

A home equity loan can be used for just about anything - from paying off high interest credit cards to making home improvements. For specific legal or financial advice, please consult a licensed attorney or a financial professional. It's the dream of many Americans to be able to afford a home, and credit problems don't have to prevent you from reaching your goal of becoming a homeowner. All three credit bureaus will work on your behalf to dispute potentially inaccurate information that is lowering your score. You own your own home and for ten years you've been paying your mortgage on time.

This contract was assigned to wescom credit union on, under a. This can be particularly helpful when you have a poor credit score. Plan, budget and write letters to dispute erroneous information on your report. Shop around for quotes from at least three lenders so that you can compare interest rates, annual fees, closing costs and loan terms. Collateral requirements tend to be higher for bad credit borrowers.

Bank Owned Properties For Sale

When comparing quotes, look at the potential advantages and drawbacks of each loan, such as the type of interest rate, which may be variable or fixed; the minimum purchase amount; the annual percentage rate; and the repayment terms. The lending and banking crisis has not gone away and lenders are not willing to change lending practices to assist bad credit borrowers. You may be nervous about whether you will be approved for a HELOC that you can use for major purchases such as home repairs, school tuition or a new car. These requirements are not easy to meet because asking a relative or friend to place their credit history on the line for you is very risky for them. A bad credit, home equity line of credit may be available to you. Once you prove that you can pay back loans on time, you will be allowed to borrow more at better overall loan rates.

Over-limit credit cards, late payments and collections accounts are three common reasons for low credit scores. But you have rights; under federal law, if a lender takes adverse action against you (such as denying your application for credit or charging you a high interest rate), you are entitled to a free explanatory report. Among the best HELOC rates available, experienced professionals, prompt response and terms suited to your needs are the hallmark of LoansStore.com. The value of the home is established by local market conditions and there isn’t anything you can do to alter that.

Those improvements and repairs can increase your home’s value and be the source for the cash to pay for them. This is the best way to improve your credit situation and put yourself in a better position with a lender in order to obtain loan approval for a home equity loan. However, after this time has passed, you can show lenders that you have reformed through responsible loan payments and managing of debt. This means that you might want to refinance your mortgage. Not only is this a worthy reason to use the equity you have built up in your home but, it may be tax deductible while other types of loans for these purposes may not.

If you're looking to get cash out of your home, then a refinance mortgage loan [http. The financing you choose for your home is just as important as the house itself. Remember that your ability to manage your debt is the biggest way companies judge you. Morehead city www townofmorehead land and home packages in morehead city n c com is part of the crystal coast. If, for example, you pay off the loan ahead of schedule, you can essentially cash out the difference before you relocate.

Her favorite things to do on wikiHow include re-writing articles that have been nominated for deletion so that they can be kept, expanding stubs, and making bold edits. The decreases in home values in many real estate markets may make a HELOC loan difficult to obtain if you have only been in your home for a few years and you put down a minimum down payment. Viral Marketing Ideas - That Will Help You Become Wealthy. There are certain lenders who will be the best to use, these are generally private lenders found over the internet.

Since a borrower’s credit rating is one of the biggest influences on a loan and its interest rate, making a promise to extend a loan without corresponding proof of creditworthiness means that there may be information missing with regards to fees, charges penalties and the true cost of the loan. Learn how getting a bad credit home equity loan can help rebuild your credit. Get the lowest fha streamline refinance rates.

Just as it is for most Americans, your biggest single asset is your home. Internet Marketing Tips for Online Home Business. Adding that deck or extra bedroom can make your home a more pleasant place while home equity w bad credit providing more livable space and very importantly, adding more value. And unlike a home mortgage loan, where you pay against the "principal," a home equity loan is all based on interest payments.

Banks and other traditional lending institutions such as credit unions need to be careful with home equity w bad credit how many bad credit loans they offer since they operate in many different financial fields. Medical bills, other high interest installment loans can make living difficult. You may qualify for more than $250,000 in coverage if you hold deposits in different account ownership categories.

With bad credit, it may not be a question of whether or not you can get a home equity loan but how much it will cost you. Renovations and remodeling are also good uses for a home equity loan, as they enhance the value of your property. If you have bad credit, you still have a chance of getting a home equity loan. Have you ever thought of taking out a home equity loan or line of credit.

A bad credit home equity loan rate will be higher than the loan rates for a. If you are facing a big expense - like college tuition or home repairs - and you own your home, a home equity loan might make sense. Today there are three major credit reporting agencies.

Again, the use of a home equity loan can help reduce these payments and improve bad credit over time. Using the equity in your home through a line of home equity credit to consolidate these debts at a lower interest rate than those available on most credit cards and makes very good sense. Home equity is the difference between what your home equity w bad credit house is worth and what you owe on it.

Cheap Used Cars Queens Ny

When you decide to refinance at either a lower or higher rate (as compared to your then-current home mortgage loan rate), you should first consider how long you expect to live in your home. And since buying a home is arguably the biggest investment most people will ever make, home equity loans allow you to turn that investment into cash. Lowering interest rates for a borrower with bad credit requires the borrower to address their credit situation. Cash which you can use for many worthy purposes like debt consolidation, home improvements/ repairs, or financing a college education for you, your spouse or your son or daughter.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research