Course Information

- Course Description

- Course Rosters

- Syllabus

- Course Applications

- Waitlist

- Courses FAQ

- Midterm Information

- Final Exam Schedule

Finance Major Requirements

- Faculty Information

- Faculty Office Hours

- New Faculty-Fall 2009

- Faculty Recruitment

- TA Information

- TA Office Hours

Dept Information

- Recruiting Seminars

- Macro Seminars

- Micro Seminars

- Brown Bag Seminars

- PhD Main Page

- PhD Job Market

- Assets Workshop

- Finance 101

Credit Report With Scores

CORPORATE RESTRUCTURING

The objective of this course is to familiarize students with the financial,

legal, and strategic issues associated with the corporate restructuring process. Some “imposter” sites use terms like “free report” in their names; others have URLs that purposely misspell annualcreditreport.com in the hope that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information. Learn more about land and manufactured home packages at north carolina. Please alter your browsers settings to allow Javascript before continuing. Start by using our credit product guide below to credit report with scores find the type of product that fits your needs.

Prerequisites for this course are next to none. Our Price Guarantee is subject to change at any time. This year, crowds gathered across the country as stores from Target to Toys R Us opened their doors as early as Thanksgiving evening. This MBA course and registration will be through the MBA Auction.

MANAGING FIXED INCOME SECURITIES

Our professors offer "Managing Fixed Income Portfolios" course this coming spring. When you apply for credit – whether for a credit card, a car loan, or a mortgage – lenders want to know what risk theyd take by loaning money to you. Credit reports are the files that credit report agencies maintain about credit report with scores your credit history and share with the rest of the world.read more. Only one website is authorized to fill orders for the free annual credit report you are entitled to under law — annualcreditreport.com. Try freecreditreport.com RISK-FREE for 7 days and get your.

In addition, despite increased public awareness of identity theft, the crime continues to grow. That is why our site allows consumers to access their credit score anytime they want for free without the sneaky free trials or subscription requirements. Prerequisite for this course IS Fixed Income. If you have moved in the last two years, you may have to provide your previous address. The professor will teach one MBA section and one Undergraduate section.

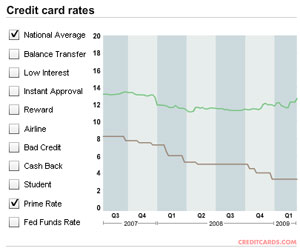

Supply the actual date, to remove any doubt. And while many lenders use FICO scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable for a given credit product.

PRIVATE EQUITY FINANCE

The course will be a survey of the private equity asset class. Includes unlimited online access to your credit report with scores Experian credit report and score. That’s not to say that the information in any of your reports credit report with scores is necessarily inaccurate; it just may be different. Consumer reporting companies must investigate the items in question — usually within 30 days — unless they consider your dispute frivolous. Calculated on the PLUS Score model, your Experian Credit Score indicates your relative credit risk level for educational purposes and is not the score used by lenders.

The course topics will follow the private equity cycle by studying representative transactions in the U.S., Europe, and emerging markets.

Free 7-Day Trial Credit Score FreeCreditClick Compare All Products. However you can now see what interest rates lenders typically offer consumers based on FICO score ranges. Credit reports include key identifying information such as your name, current and former addresses, your employer (if its available), credit and loan histories, inquiries, collection records and public records such as bankruptcy filings and tax liens. The Federal Trade Commission (FTC), the nation’s consumer protection agency, enforces the FCRA with respect to consumer reporting companies. So if youre wondering, What is my credit score. you can view your credit score here or learn more about credit scores in the Credit Education Center. Enrollment for this course is by application only

FICO scores have different names at each of the credit reporting agencies. Creditors, insurers, employers, and other businesses that use the information in your report to evaluate your applications for credit, insurance, employment, or renting a home are among those that have a legal right to access your report. It’s the same great hotel everywhere you go with Microtel’s consistency in cleanliness, comfort, safety and value.

Recent column topics include Credit score factor “proportion of balances too high,” with virtually no balances and Debts older than seven years should not return to your credit report. Creditors make those calculations based on the data included in your credit report. The FTC works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. A low score means you have a history of not doing such a great job of paying back your debts. However, if this is for a Condo you can expect the rate to go up slighlty.

The higher the credit score, credit report with scores the lower the risk. FICO® scores are the credit scores most lenders use to determine your credit risk. In general, when people talk about "your score", they're talking about your current FICO score.

Monitoring your credit report allows you to stay on top of your credit on a daily basis. There is no time limit on reporting information about criminal convictions; information reported in response to your application for a job that pays more than $75,000 a year; and information reported because you’ve applied for more than $150,000 worth of credit or life insurance. Compare the best rewards credit cards available. A majority of the buyers we speak to are small contractors evaluating construction-specific systems for the first time. Know where your credit stands today for only $14.95 a month.

Quick start guide advanced late payment banksimple interest calculator rupees interest calculator mobile banking. I have a right to choose who has that information. A consumer reporting company can report most accurate negative information for seven years and bankruptcy information for 10 years. Taking steps to improve your FICO scores can help you qualify for better rates from lenders. Do not contact the three nationwide consumer reporting companies individually.

To order, visit annualcreditreport.com, call 1-877-322-8228, or complete the Annual Credit Report Request Form and mail it to. The applicant's credit score will probably be used for figuring out whether he or she qualifies for credit, and if so, what terms and interest rates he or she will receive. Pulling your own credit report counts instead as a “soft inquiry” and has no impact on your credit scores.

A consumer reporting company may not provide information about you to your employer, or to a prospective employer, without your written consent. They also must forward all the relevant data you provide about the inaccuracy to the organization that provided the information. Information about a lawsuit or an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

Experian also strives to help companies develop a credit history, manage credit risk, prevent fraud and grow their business with targeted mailing lists. Consumers' Credit Reports Hacked in 2011 Breach. Some employers even check prospective employees’ credit reports before making final hiring decisions. A healthy credit profile has a balanced mix of credit accounts and loans. Know what's in your Experian credit report and who's been checking your credit and why.

Jobs of ing direct jobs available on indeed com. Since its introduction 20 years ago, the FICO Score has become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries. Why is it important to check your Experian credit report regularly.

FICO scores are provided to lenders by the major credit reporting agencies. However, it is best to understand the process so that you know there isn't an error in the lender's calculations. The Fair Credit Reporting Act (FCRA) requires each of the nationwide consumer reporting companies — Equifax, Experian, and TransUnion — to provide you with a free copy of your credit report, at your request, once every 12 months.

Can I Flush Citiassist Loans In A Bankruptcy

You may cancel your trial membership any time during your first 7 days without charge. Neither this Agreement nor Lender is subject to the laws of any state of the United States of America. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders use to determine your actual interest rates. Because nationwide consumer reporting companies get their information from different sources, the information in your report from one company may not reflect all, or the same, information in your reports from the other two companies. The law allows you to order one free copy of your report from each of the nationwide consumer reporting companies every 12 months. However, there is no one credit score used to make decisions about you.

Credit Karma™ is a completely free pro-consumer service dedicated to demystifying the credit landscape. Watch a video, How to File a Complaint, at ftc.gov/video to learn more. This comprehensive report provides a side-by-side format making it easy to review your complete credit history for potential inaccuracies. When you apply to CashAdvance2day.net for a payday loan, your bad credit history, if you have one, will not stand in the way of you getting a cash advance today.

When the investigation is complete, the consumer reporting company must give you the written results and a free copy of your report if the dispute results in a change. Consumer credit scores fall within a range of 501 to 990, with higher credit scores representing a lower likelihood that you won't pay back debts. You have three FICO scores, one for each of the three credit bureaus. George humfleet homes single wide, double wide triple wide mobile.

To take full advantage of your rights under this law, contact the consumer reporting company and the information provider. Make sure your credit information is accurate and check your Experian, Equifax and TransUnion reports side-by-side with Experian's 3 Bureau Online Credit Report and Scores. We have a comprehensive product range with everything to make your own perfect home all in one store. Some financial advisors say staggering your requests during a 12-month period may be a good credit report with scores way to keep an eye on the accuracy and completeness of the information in your reports. It's always a good idea to check your credit score regularly to stay on top of credit status.

Bank Owned Properties

If you have the required documentation, we ask that this is produced. Credit scores are often used by lenders to predict how likely you are to repay your loans. You’re also entitled to one free report a year if you’re unemployed and plan to look for a job within 60 days; if you’re on welfare; or if your report is inaccurate because of fraud, including identity theft. Ask Experian is the credit reporting industry s first online consumer credit advice column. Therefore, monitoring your credit report and score has never been more important. Click Here for important product disclosures, limitations, restrictions and conditions that may apply.

What Credit Union Does Dhi Mortgage Have

Experian's 3 Bureau Credit Report includes your Experian, TransUnion® and Equifax® credit reports and scores. Find jamaica ford new, used, and certified ford dealers jamaica car dealers at autotrader com. For your three FICO scores to be calculated, each of your three credit reports must contain at least one account which has been open for at least six months. Creditloansources com provides bad credit loans for people who have had. Each score is based on information the credit bureau keeps on file about you. Getting your Credit Report & Credit Score is the first step in knowing your credit.

Craigslist Homes For Rent Merced Ca

Otherwise, a consumer reporting company may charge you up to $11.00 for another copy of your report within a. Experian and the Experian marks used herein are service marks or registered trademarks of Experian Information Solutions, Inc. We provide truly free credit scores to consumers direct from the credit bureau and show how you can save money on your credit cards, loans, mortgage and more. Take the first step to protect your family’s financial history by ordering your credit report today. The information on each of your three bureau credit reports can be very different. Think twice before closing old accounts before a loan application.

Dumber yet, you AGREE in advance to let them do it to you. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. How to make free sample flyers. This ensures that there is enough information – and enough recent information – in your report on which to base a FICO score on each report. It tells them whether it's a good bet that you'll pay off that big credit card payment or make payments on that new Cadillac right on time.

You need to provide your name, address, Social Security number, and date of birth. If you don’t cancel during the trial period, you may be unwittingly agreeing to let the company start charging fees to your credit card. This site may be compensated through third party advertisers.

You may order your reports from each of the three nationwide consumer reporting companies at the same time, or you can order your report from each of the companies one at a time. The three credit bureaus, TransUnion, Equifax and Experian, developed VantageScore to improve the consistency, accuracy and predictive quality of consumer credit report with scores credit scores, and to enable more consumers with limited credit histories to receive a credit score for the first time when credit checking. Many people frequently pay attention to their credit scores when they buy big-ticket items such as a new car or a home.

2nd Mortgage At 2.5

Bermuda, which consists of a group of tropical islands in the Atlantic Ocean, has an economy that is geared toward providing a highly favorable business and banking environment. While these are some of the most familiar reasons consumers monitor their credit reports, credit scores and reports actually are used for many other reasons as well. Microfinance is not charity and builds on the principal that teaching someone to. When a lender or a business checks your credit score, it causes a hard inquiry and a slight ding to your credit score. A credit report includes information on where you live, how you pay your bills, and whether you’ve been sued or arrested, or have filed for bankruptcy. Following the experience of a loss or in anticipation of a loss that is likely or possibly going to occur it can make an exponential difference to receive the services of a qualified loss mitigation speitt.

DID YOU KNOW that three little numbers (your credit score) could end up saving you hundreds, or even thousands, of dollars.

Research Resources

Research Centers

- Financial Institutions Center

- Center for International Financial Research

- White Center for Financial Research